tax loss harvesting example

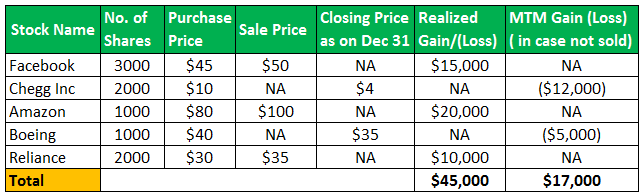

Jessica purchases one BTC for 19000 holds it for three months and sells it for 21000. Lets look at a simplified example of tax-loss harvesting in action first with ETFs.

Tax Loss Harvesting And Wash Sale Rules

Lets say Peter buys 100 shares of a utility stock call it stock ABC at 10 per share or 1000 invested.

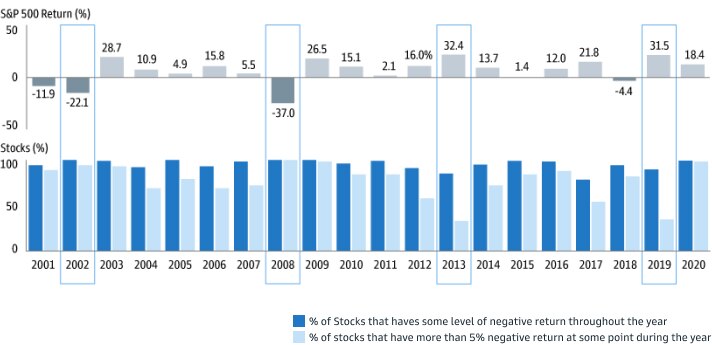

. After a few months stock ABC falls to. Tax loss harvesting example. Well imagine you have a portfolio with a share of SPY in.

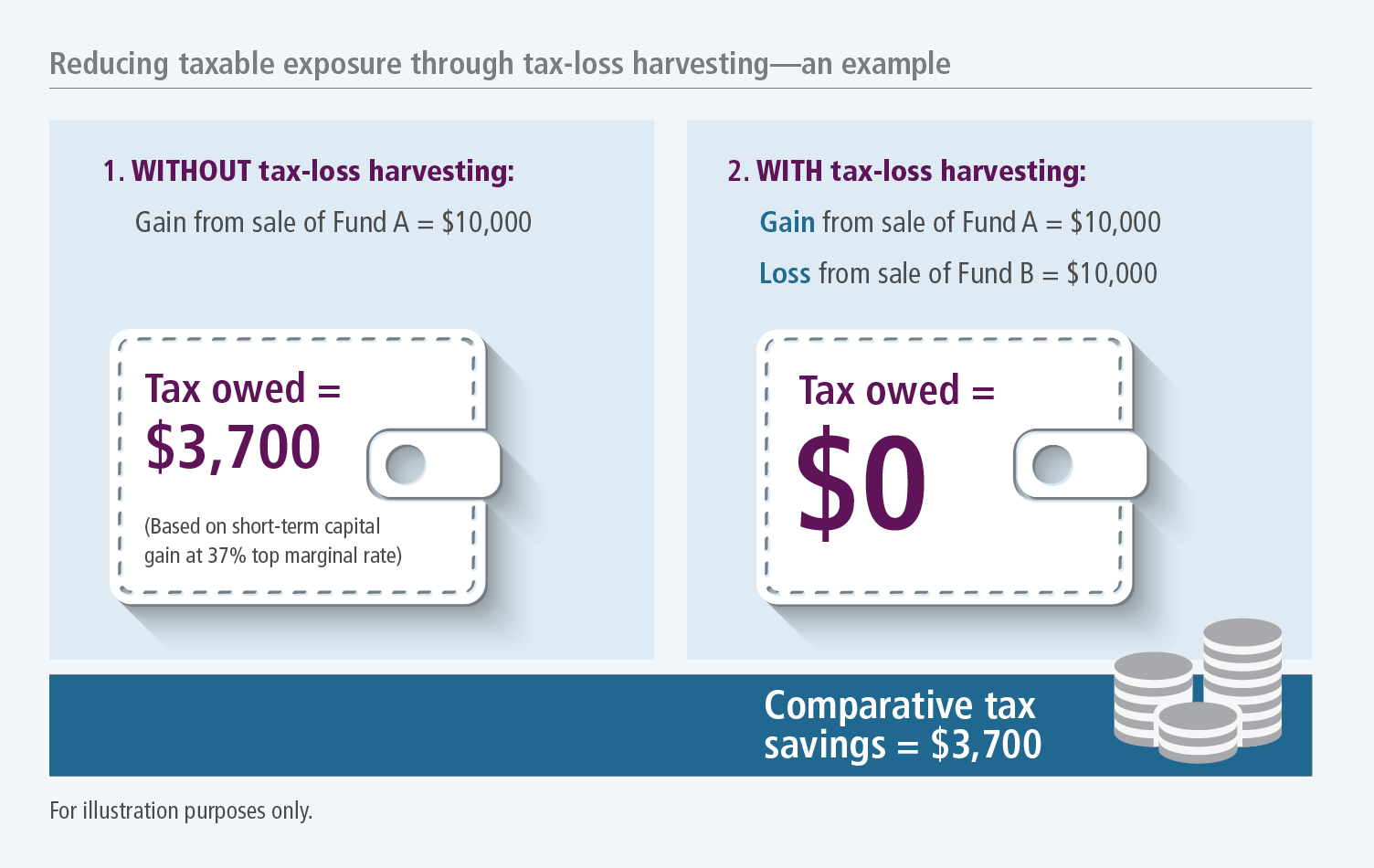

Ill use the following example to explain how tax-loss harvesting might work inside an ETF portfolio not actual returns for illustration only. Assuming youre subject to a 35 marginal tax rate the overall tax benefit of. Example of a Crypto Tax Loss Harvesting Scenario Suppose you bought 2 Bitcoins for 5000 and 5 Ethereum for 9000 in 2019.

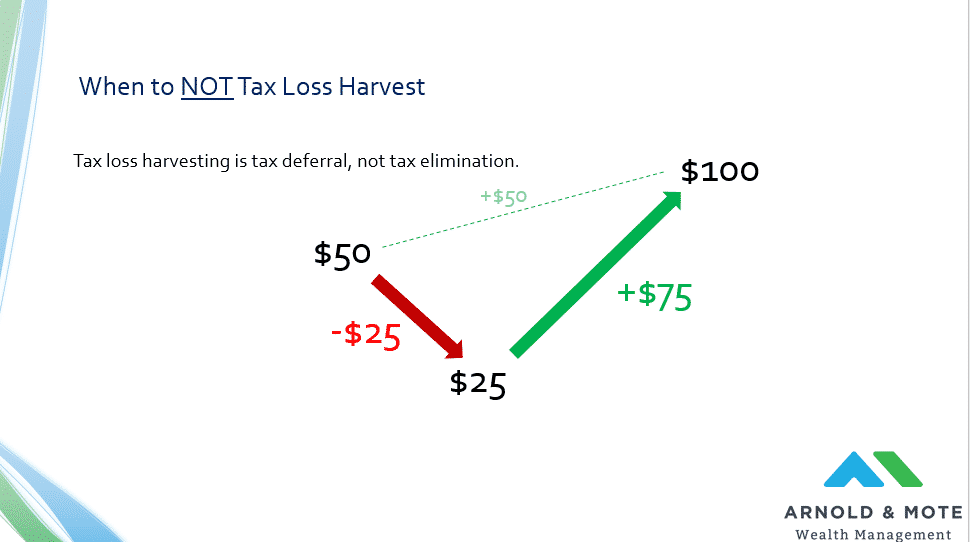

Lets move on to how to tax-loss harvest by using a tax-loss harvesting example. Tax Loss Harvesting ETF Example. The leftover 2000 loss could then be carried forward to offset income in future tax years.

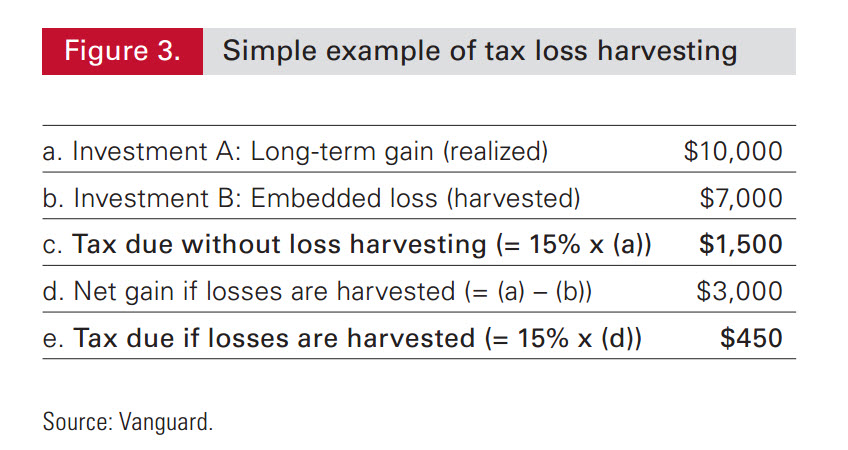

Because of tax loss harvesting your gain and loss offset each other to generate a net long-term gain of 15000. Investors can use a tax-loss harvesting calculator to assist them with. One of the most powerful benefits of tax-loss harvesting stems from the fact that after offsetting other capital gains the first 3000 1500 if married filing separately you.

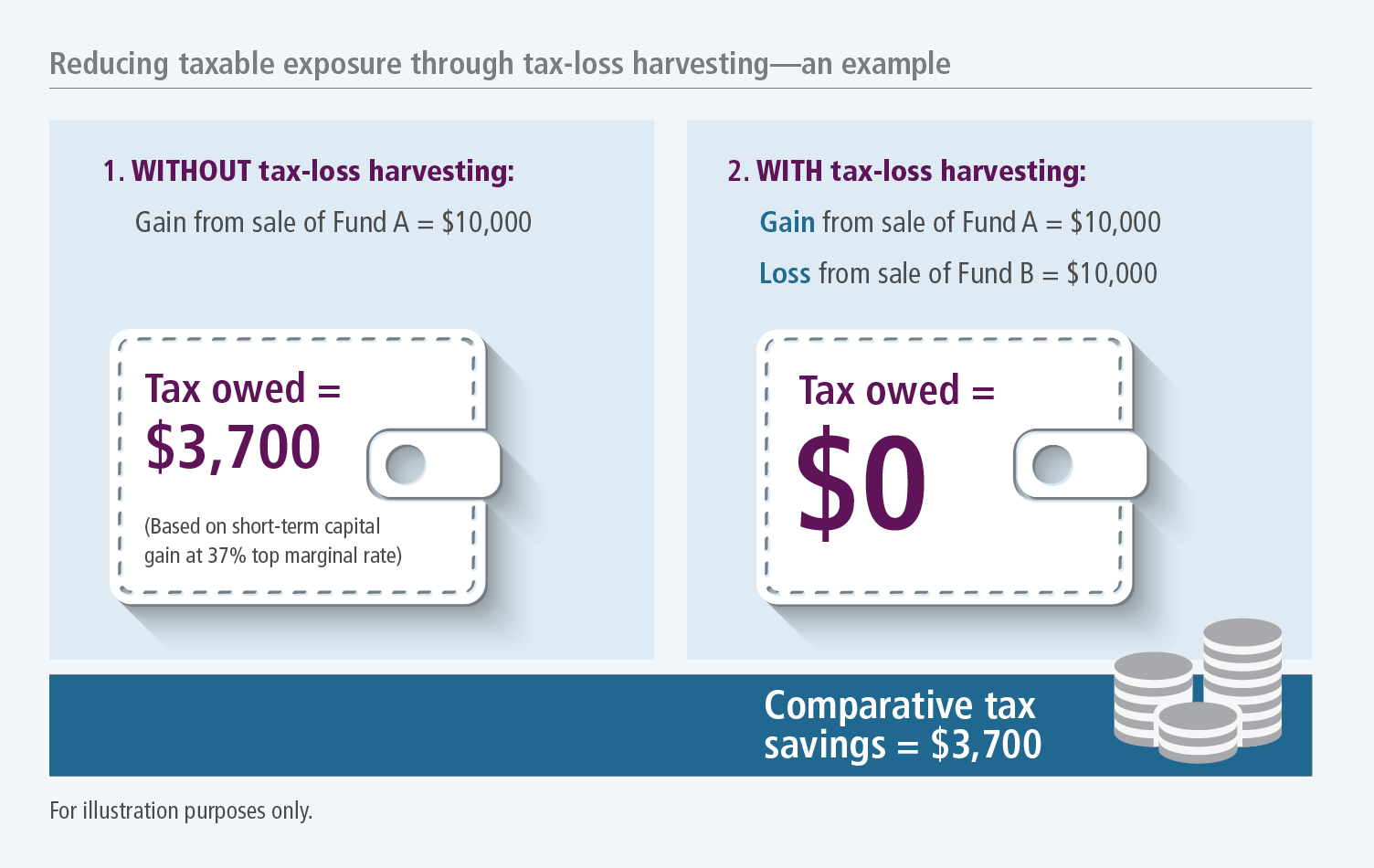

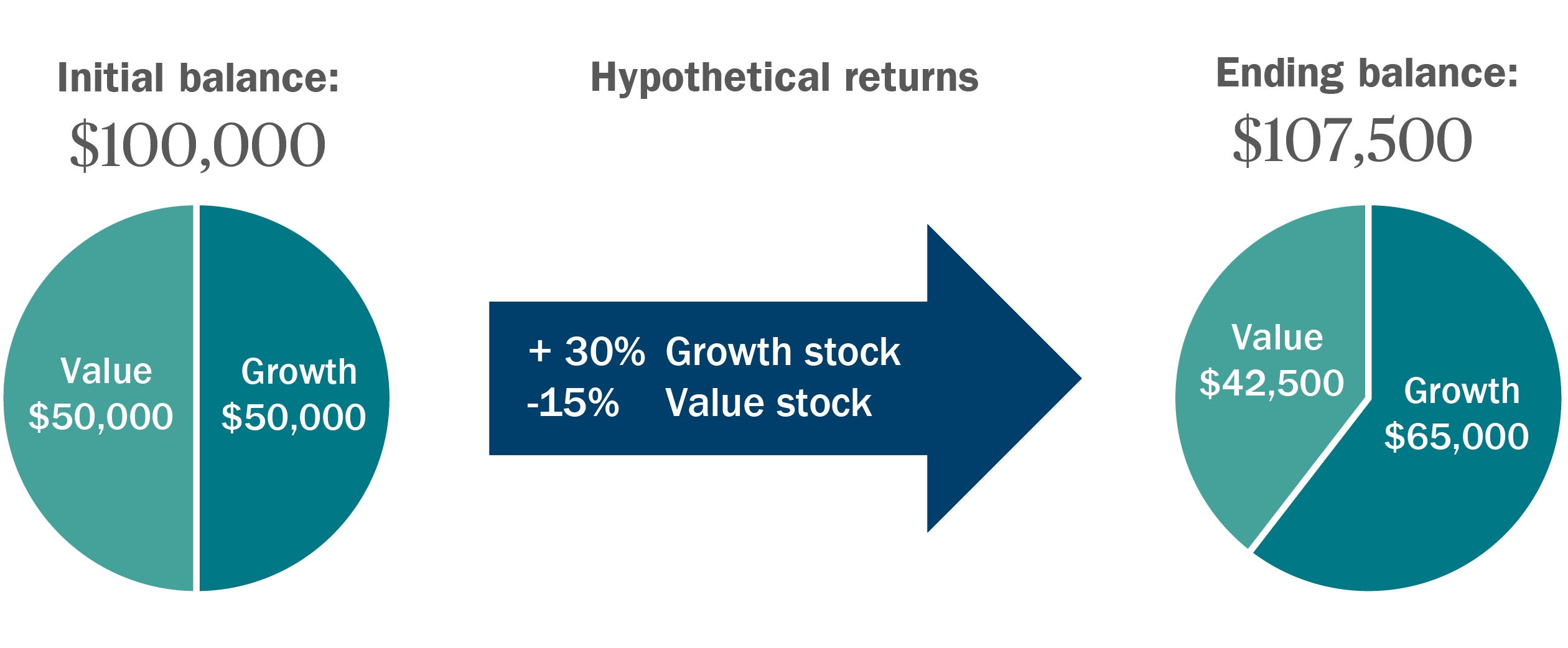

An example of the potential benefits of tax-loss harvesting Assume we have a strategic allocation in a non-qualified account that is split between a growth and value stock where the growth. Tax Loss Harvesting Example Heres a standard example of tax loss harvesting. Tax loss harvesting example If you sold an investment property youd owned for less than 12 months and realized a profit that profit would be subject to short-term capital.

In addition if you have more losses than you do gains you can take up to 3000 and thats the maximum of those losses and use those to offset other ordinary income. Tax-loss harvesting with ETFs. Two years later you sell the 2 BTC for 8000.

Elect to sell Investment B which generates a 15000 long-term loss.

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Reduce Taxes With Tax Loss Harvesting

Turning Losses Into Tax Advantages

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tax Loss Harvesting Strategies How They Work

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Tax Loss Harvesting Guide 2022 Beat Capital Gains

Tax Loss Harvesting A Guide To Save On Capital Gains

How To Make Your Investments Less Taxing

Tax Loss Harvesting How To Benefit From Your Losses Caissa

Tax Loss Harvesting What Is It Rules Example Benefits

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting More Than A Year End Tax Strategy

What Is Tax Loss Harvesting Russell Investments

Tax Loss Harvesting Year End 2018 John Hancock Investment Mgmt

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

What You Need To Know About Tax Loss Harvesting Ameriprise Financial Justin Samples Ameriprise Financial