jefferson parish property tax sale

In addition to the sales tax levied on the furnishing of rooms by hotels motels and tourist camps an occupancy tax is imposed on the paid occupancy of hotelmotel rooms located in the Parish of Jefferson. Ad Find Tax Foreclosures Under Market Value in Louisiana.

This is the total of state and parish sales tax rates.

. The jefferson parish sales tax is collected by the merchant on all qualifying sales made within jefferson parish. TRUSTMARK NATIONAL BANK VS TROY A. They are maintained by various government.

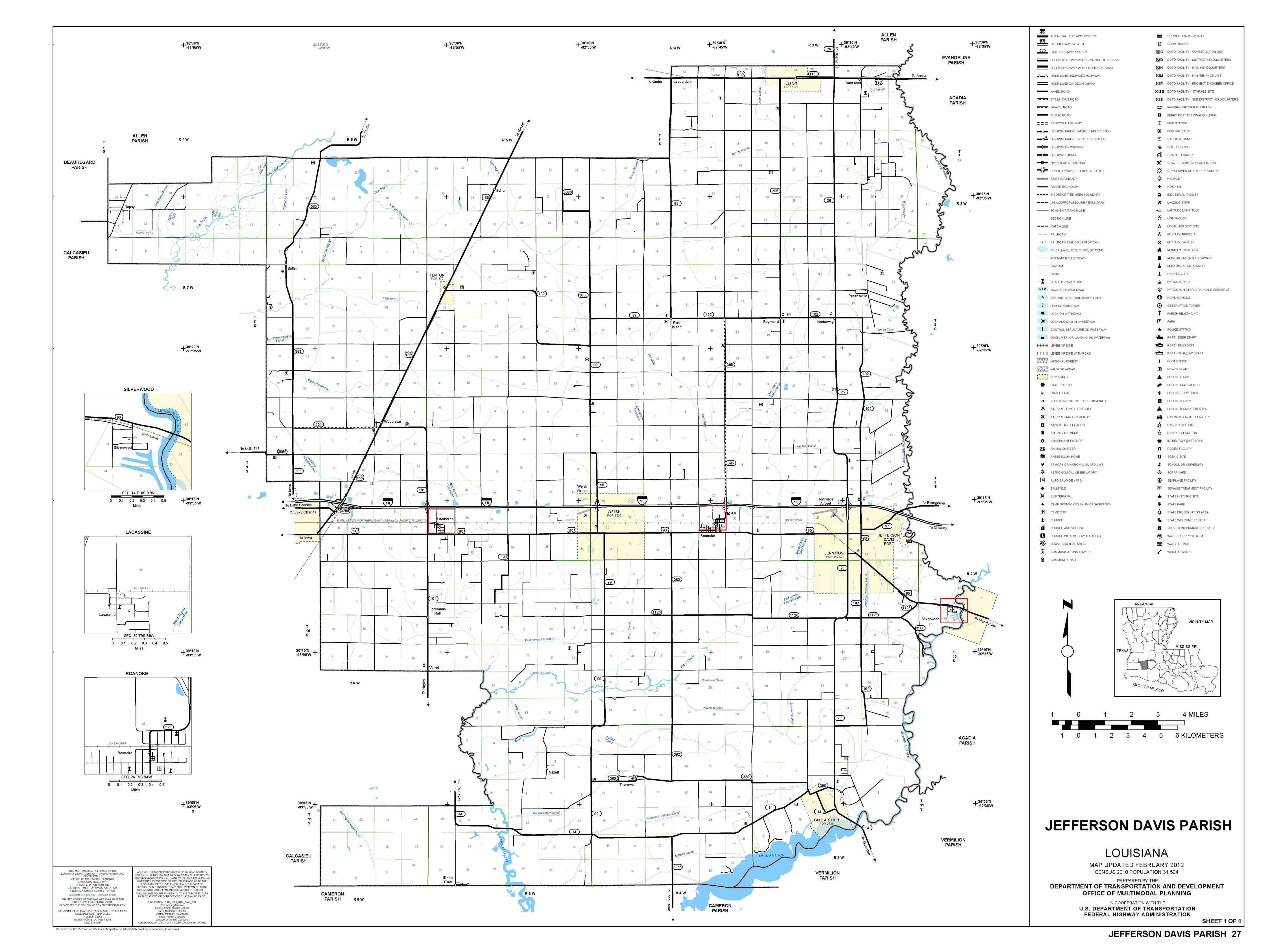

240 CORETTA DR WESTWEGO LA. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. The Tax Sale is held at the Jefferson Davis Parish Courthouse located at 300 N.

What is the sales tax rate in Jefferson Parish. The 2018 United States Supreme Court decision in South Dakota v. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

11 rows STANDARD MORTGAGE CORPORATION VS THE UNOPENED SUCCESSION OF DORIS FRANCIS COOPER DECEASED. OVERVIEW Today BGR releases three reports on Jefferson Parish tax renewals for drainage works juvenile services and animal shelter and health services that voters will consider on November 6 2018. Detailed listings of foreclosures short sales auction homes land bank properties.

If approved each tax would be renewed for 10 years from 2021 to 2030. The sale of Louisiana Tax Deeds Hybrid are final and winning bidders are conveyed either a Tax Deed or a Sheriffs Deed. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill.

Parish Attorneys Office Code Collections 200 Derbigny St. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. Generally the minimum bid at an Jefferson Parish Tax Deeds Hybrid sale is the amount of back taxes owed as well as any and all costs associated with selling the property.

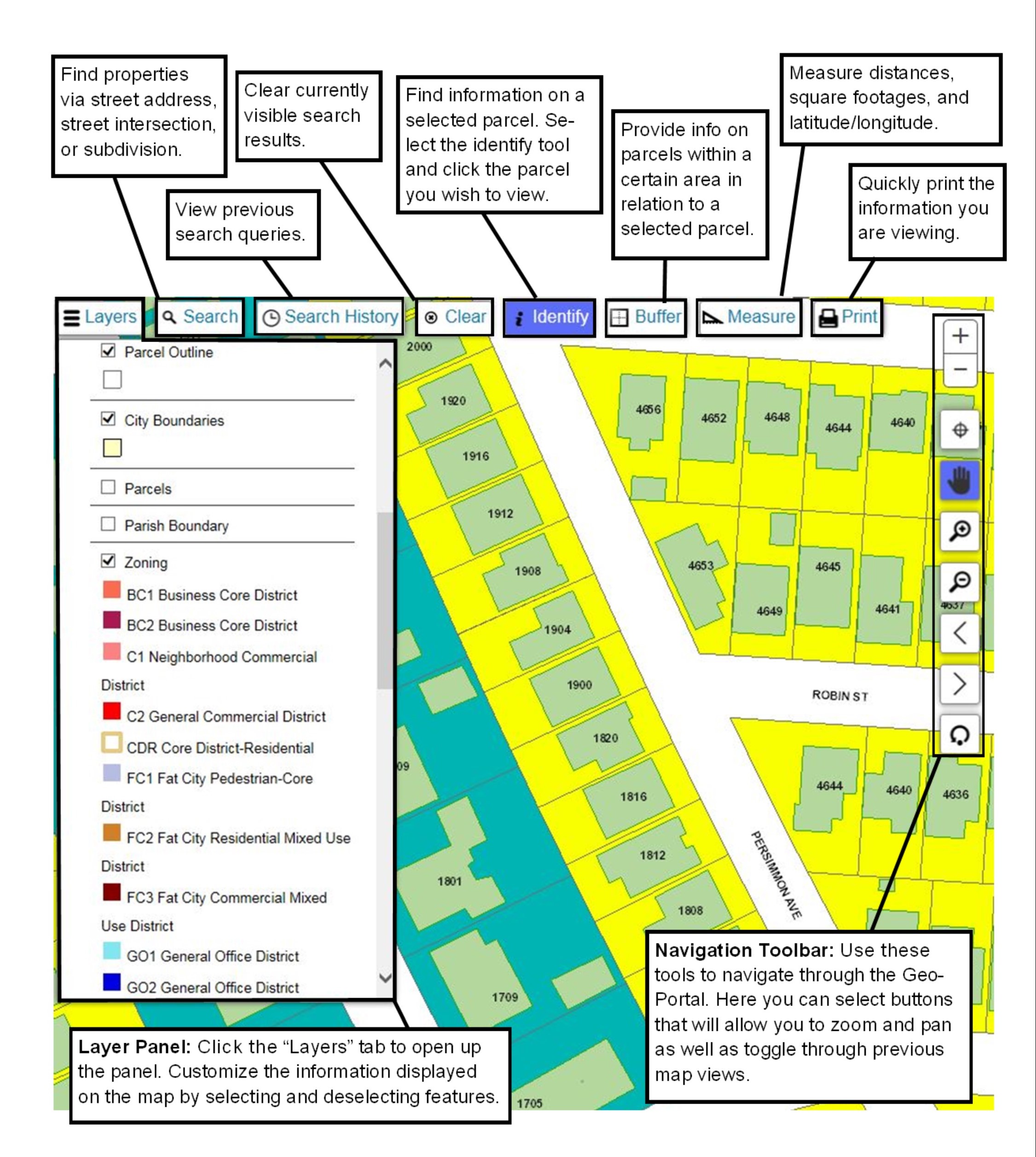

The exact property tax levied depends on the county in louisiana the property is located in. Jefferson Drainage Property Tax Renewal Voters in Jefferson. These online services are available 24 hours a day 7 days a week and provide a secure fast and convenient way to pay traffic tickets and to file and remit Jefferson Parish sales license and property taxes.

1233 Westbank Expressway Harvey LA 70058. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. This auction includes 57 properties located throughout Jefferson Parish including properties in Metairie Jefferson.

Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Adjudicated Property Auction to be Held Online on August 15 August 19 2020. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more.

Jefferson Parish Assessors Office. Box 9 Gretna LA 70054 Fax. Property tax bills may be remitted via mail hand-delivery or paid online at our website.

Total property taxes owed in jefferson for 2020 are 4351 million up 05 from 4327 million in 2019. The following local sales tax rates apply in jefferson parish. Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Airport District Tax In addition to the salesuse tax imposed on transactions occurring in Jefferson Parish an additional levy is. Commercial Fisherman The sale of materials and supplies which qualify for an exclusion and exemption under LSA-RS. GGB Suite 5200 PO.

4730520 when sold to a Louisiana Commercial Fisherman who qualifies as such under applicable state law and who complies with certification procedures developed by the Jefferson Parish Sheriff as tax collector for Jefferson. However according to state law Tax Deeds Hybrid purchased at an Jefferson. A separate tax return is used to report these sales.

Jefferson Parish Assessors Office - Property Search. Jefferson Parish Sheriffs Office. Jefferson parish collects on average 043 of a propertys assessed fair market value as property tax.

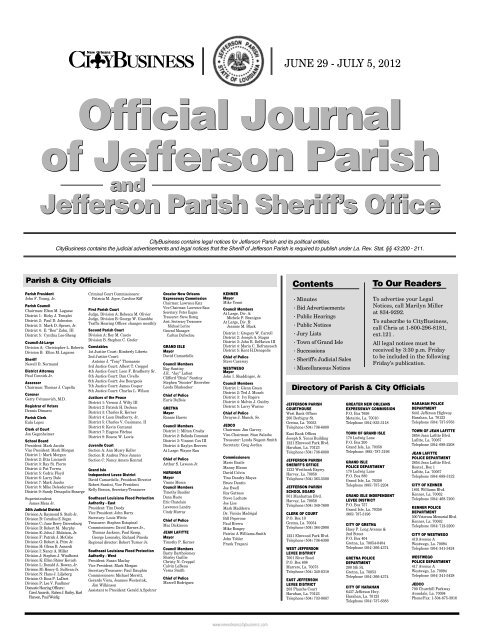

Administration Mon-Fri 800 am-400 pm Phone. This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that. Click Here to view the latest Judicial Advertisement as published in The New Orleans Advocate.

Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 Gretna and is open to the public from 830 am. Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana. To 430 pm Monday through Friday.

You must submit your change of address in writing to the address below. Its duties also include organizing and directing annual tax sales. The Jefferson Parish sales tax rate is 475.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is 92. The JPSO is tasked with the responsibility of seizing property that is in default and holding judicial auctions and sales on behalf of the creditor. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax. Property Maintenance Zoning Quality of Life. The preliminary roll is subject to change.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Welcome to the Jefferson Parish Assessors office. Search our database of Jefferson Parish County Property Auctions for free.

The Judicial Process link provides interested persons an online listing of real estate and moveable property seized by court order and scheduled for auction at upcoming. The Louisiana state sales tax rate is currently 445. The Judicial Sales Office hours are 800 am to 430 pm Monday through Friday.

Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. The current total local sales tax rate in Jefferson LA is 9200. Payment Guidelines for Judicial Sales click here REVISED MARCH 2021.

The New Orleans Advocate contains the Judicial Advertisements and legal notices that the Sheriff of Jefferson Parish is required to publish under LA. Free jefferson parish property records search. In Building D of the Westbank Administration Complex at.

For Properties Located on the Westbank. The sales are held each Wednesday at 10 am.

St Tammany Sheriff S Office Once Again Set To Hold Tax Sale Online Wgno Com

Hurricane News And Information

Jefferson Parish Sheriff S Office Facebook

Jefferson Parish Property Tax Sale

Jefferson Parish Sales Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

2019 Tax Sale City Of Opelousas

Tax Division Jefferson Davis Parish Sheriff S Office

Faqs Jefferson Parish Sheriff S Office La Civicengage

Kenner Condo Owner Survives Summary Judgment In Tax Sale Dispute Louisiana Personal Injury Lawyer Blog June 19 2019

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Faqs Jefferson Parish Sheriff S Office La Civicengage

Tax Division Jefferson Davis Parish Sheriff S Office

Jefferson Parish Voters Approve New Property Tax Increase For Sheriff S Office Pay Raises Local Elections Nola Com

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office